Some entrepreneurs turn to small business loans or crowdfunding. planning how to fund a business is hardly trivial. If you have a business idea, you need to make a plan to attract funding. Here are some of the things that you need to consider to get money for your business idea.

- Write a consistent and convincing Business plan

The business plan should detail your idea and explain important issues for a financier such as technological process, competition, suppliers or business promotion. In order to develop a compelling business plan, it is good to decide on the business coordinates, consult models and appeal to specialists in the field.

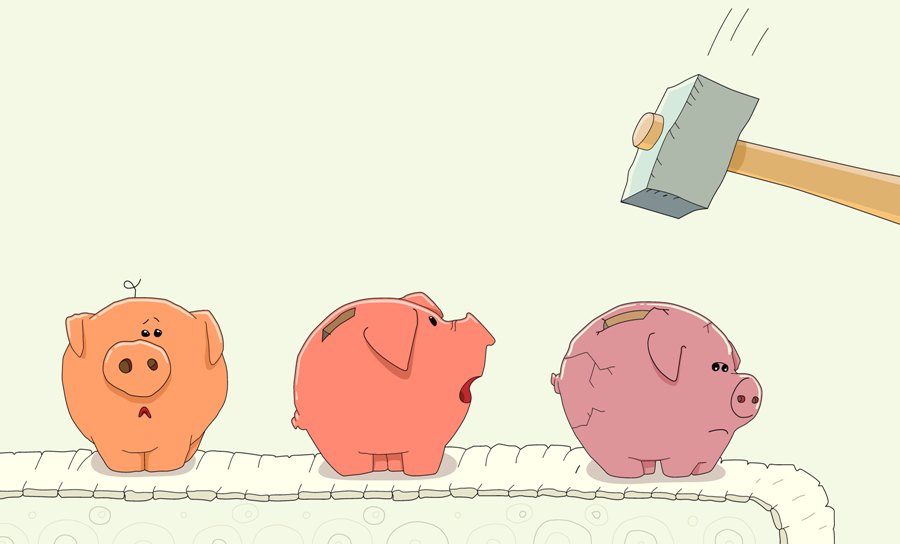

- Calculate your funding needs

It is important that when you meet a financier, you know how much money you need. Therefore, it is important to approximate as realistic as possible what is the cost of the investment, how can you ensure from your own sources and how to ask from the investor. The calculations must be based on realistic sources.

- Look for specialist support

Prior to launching your business, it is good to have specialists around you that can fill your lack of expertise in various areas: legal, accounting, marketing, production, etc. Ask for recommendations from entrepreneurs who are already working with such specialists and get their support. It is important to be aware that you can not be an expert in all sizes of your business. Moreover, a team of specialists is a strong point of the business that will impress investors.

- Build relationships

For most businesses, the importance of relationships is overwhelming. For example, a public administrative contact can guide you on the legislative steps you need to take to get opinions and authorizations, and thus save time and money. Other people can help you attract important clients and secure your income in the future. So, if you’re thinking about turning an idea into a business, you’re looking to build relationships with people who can help.

- Choose the most suitable financiers

Although any source of money for your business is welcome, we recommend that you select the most suitable financiers for you. Many entrepreneurs believe that the best source of funding is family and friends, but they may be disappointed by their refusal, especially in the case of a risky business. Other entrepreneurs are thinking of attracting unbundling funding, but find that there are no programs that fund their business idea. That’s why it’s important to identify who are the most suitable financiers for your business.